student loan debt relief tax credit for tax year 2020

Currently owe at least a 5000 outstanding student loan debt balance. The legislation also allows companies to offer up to 5250 toward an employees student loan payments on a tax-free.

Should I Pay Off My Student Loans Or Wait For Forgiveness Bloomberg

Everyone is always looking for ways to reduce their tax liabilities but many people have no idea that this significant tax deduction is widely available.

. Incurred at least 20000 in total student loan debt. Last year MHEC awarded the Student Loan Debt Relief Tax Credit to 7962 Maryland residents. The application is free.

This benefit originally included in the Coronavirus Aid Relief and Economic Security CARES Act enacted in March 2020 was for calendar year 2020 only but was extended for an additional five years by the Consolidated Appropriations Act 2021 CAA. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. Any credit youre awarded through this program must be used to pay your student loan.

Have at least 5000 in outstanding student loan debt remaining during 2019 tax year. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. The average test scores are increasing by the year with the average SAT score being around 1380-1450 and the average ACT score is 31.

As part of relief for the COVID-19 pandemic the federal Coronavirus Aid Relief and Economic Security CARES Act passed in March provides significant student loan relief in the form of deferring payments and waiving interest until Sept. Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt. 1 2026 will not count as income.

The IRS announced an expansion of relief to additional individuals who borrowed funds to attend school and later had. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. If youre married your spouses income or loan debt will be considered only if you file a joint tax return or you choose to repay your Direct Loans jointly 18.

Subsequent legislation extended the tax-free status through the end of 2025. The IRS extended its safe-harbor relief from recognizing cancellation-of-debt COD income for students whose loans were discharged either because their schools were closed or as a result of some type of fraud Rev. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and.

Complete the Student Loan Debt Relief Tax Credit application. If you are looking for some help 17. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit.

The first day you can apply for the 2020 tax-year credit is July 1 2021. Governor Larry Hogan and Maryland Higher Education Commission MHEC Secretary Dr. Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want.

One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt. 10000 x 020 20 2000 credit. Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does.

As student loan debt continues to be. Until the end of 2020 employers can contribute up to 5250 toward an employees student loan balance and the payment will be free from payroll and income tax under a provision in the Coronavirus Aid Relief and Economic. A provision in the March 2021 COVID-19 relief package stipulates that any debt forgiven from Dec.

If you pay 15000 in tuition your credit will equal 2000 because of the 10000 limit on qualifying educational expenses. February 18 2020 842 AM. Tax Relief Expanded for Student Loan Debt Discharge in Certain Cases.

31 2020 to Jan. The AOTC offers a credit of 100 on the first 2000 of qualifying educational expenses and 25 on the next 2000 for a maximum of 2500. There were 5145 applicants who attended in-state institutions and will each receive 1067 in tax credits while 4010 eligible applicants attended out-of-state institutions and will each receive 875 in tax credits.

Applying test-optional has its perks but I would advise you to take SATACT study hard for it and retake it a couple of times if needed. Fielder announced nearly 9 million in tax credits was awarded to nearly 8000 Maryland residents with student loan debt. To qualify for the Student Loan Debt Relief Tax Credit you must.

January 16 2020 by Ed Zollars CPA. From July 1 2021 through September 15 2021. 2020-11The IRS had earlier provided relief for students from Corinthian College or American Career Institutes Inc.

The Student Loan Debt Relief Tax Credit Program for Tax Year 2021 is open for applications through Sept. 15000 10000 limit so you are limited to claiming 20 of 10000. Relief is also extended to any creditor that would otherwise be.

File Maryland State Income Taxes for the 2019 year. The CARES Act made employer-paid student loan repayment assistance programs or LRAPs temporarily tax-free in 2020. Employers can provide up to 5250 annually in tax-free student loan repayment benefits per employee through 2025.

In fact the 2500 deduction can be utilized by holders of both Federal and Private student loan. Up to 5250 in employer-paid educational assistance including tuition and LRAPs is tax-free. Submitted an application to the MHEC by September 15 2019.

From July 1 2022 through September 15 2022. WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

It requires a completely separate form attached to a Form 1040 tax return and receipt of a Form 1098-T from the institution where the student was enrolled.

Why Credit Cards Can Be So Dangerous Hoyes Michalos Credit Card Credits Cards

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Tax Debt What To Do If You Owe Back Taxes To The Irs Tax Debt Owe Taxes Debt

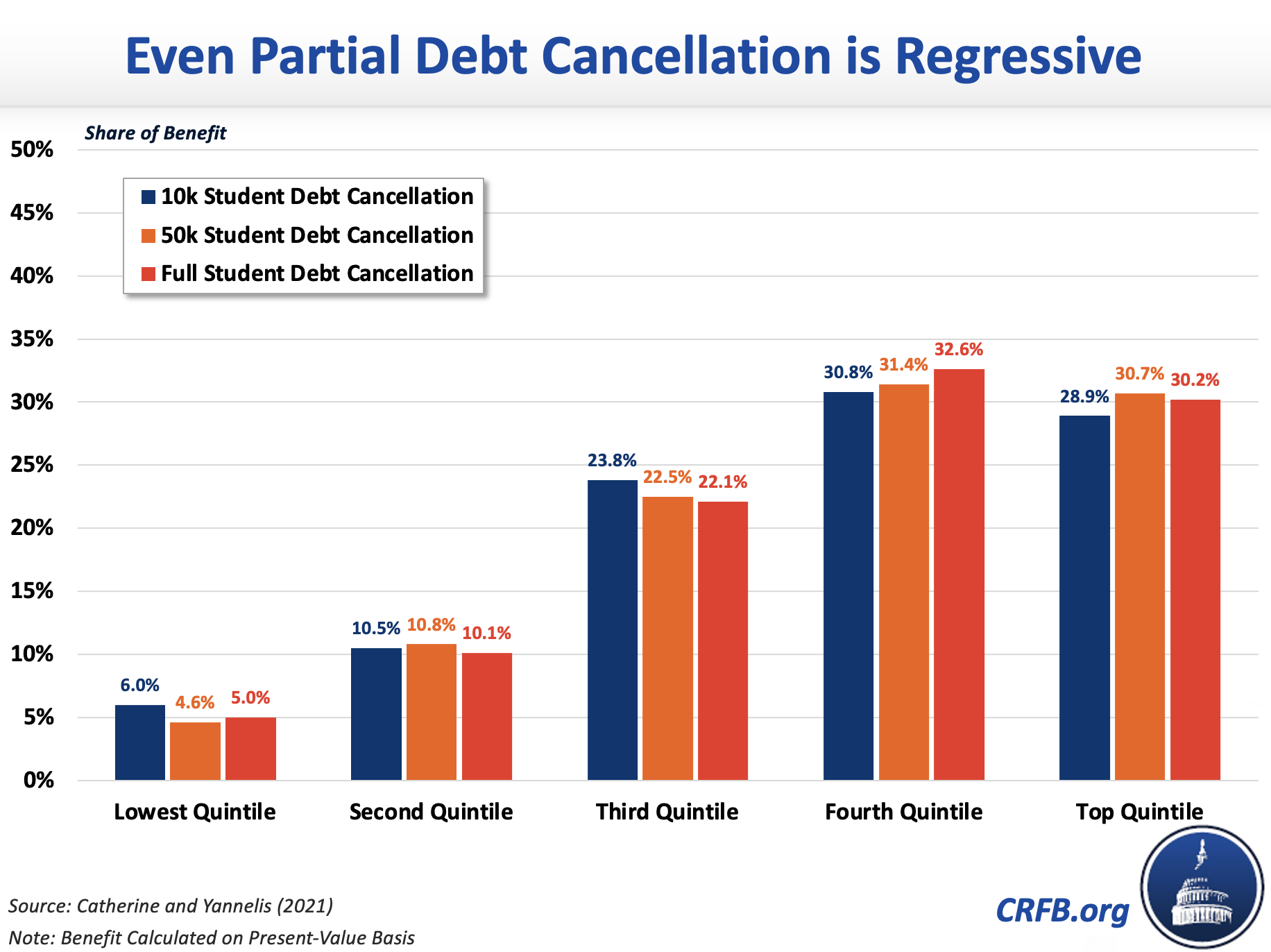

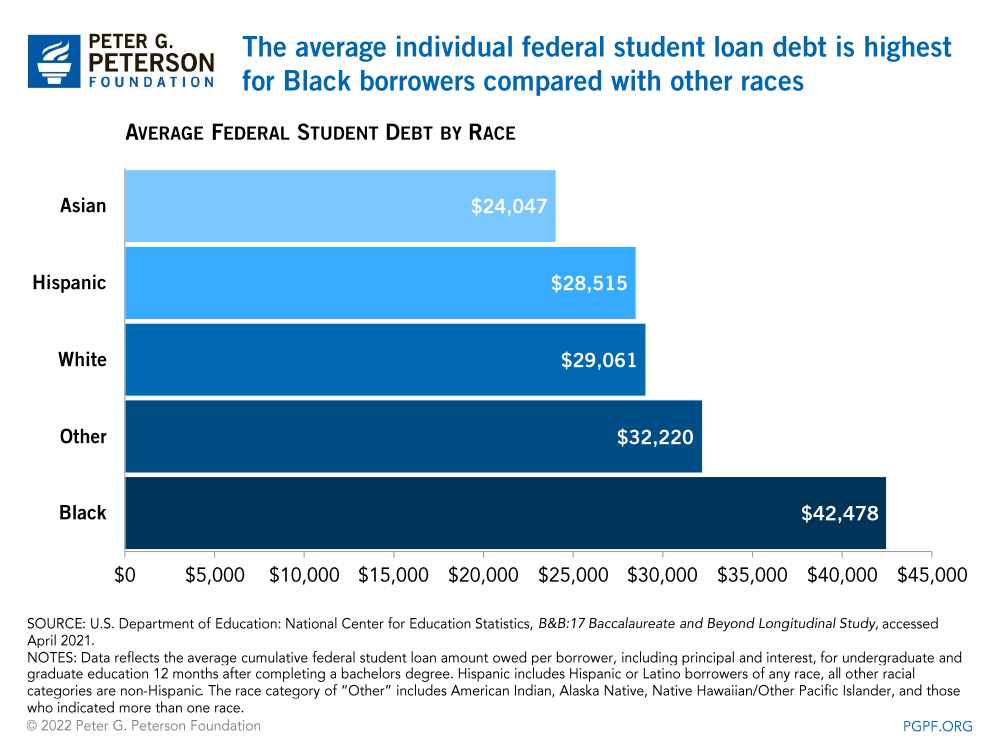

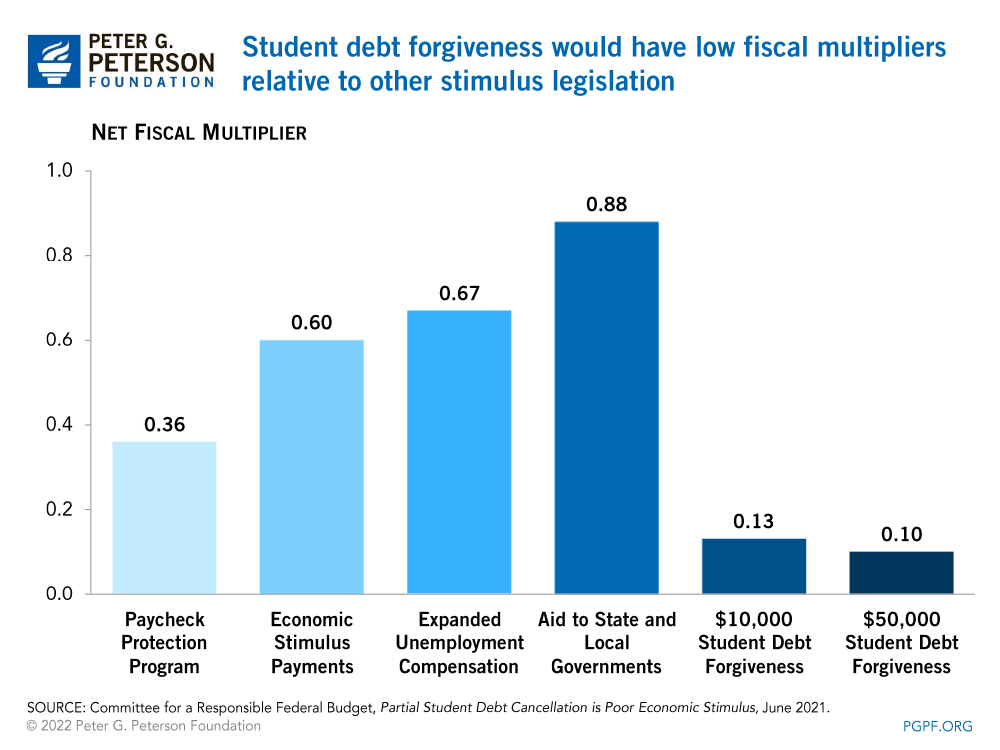

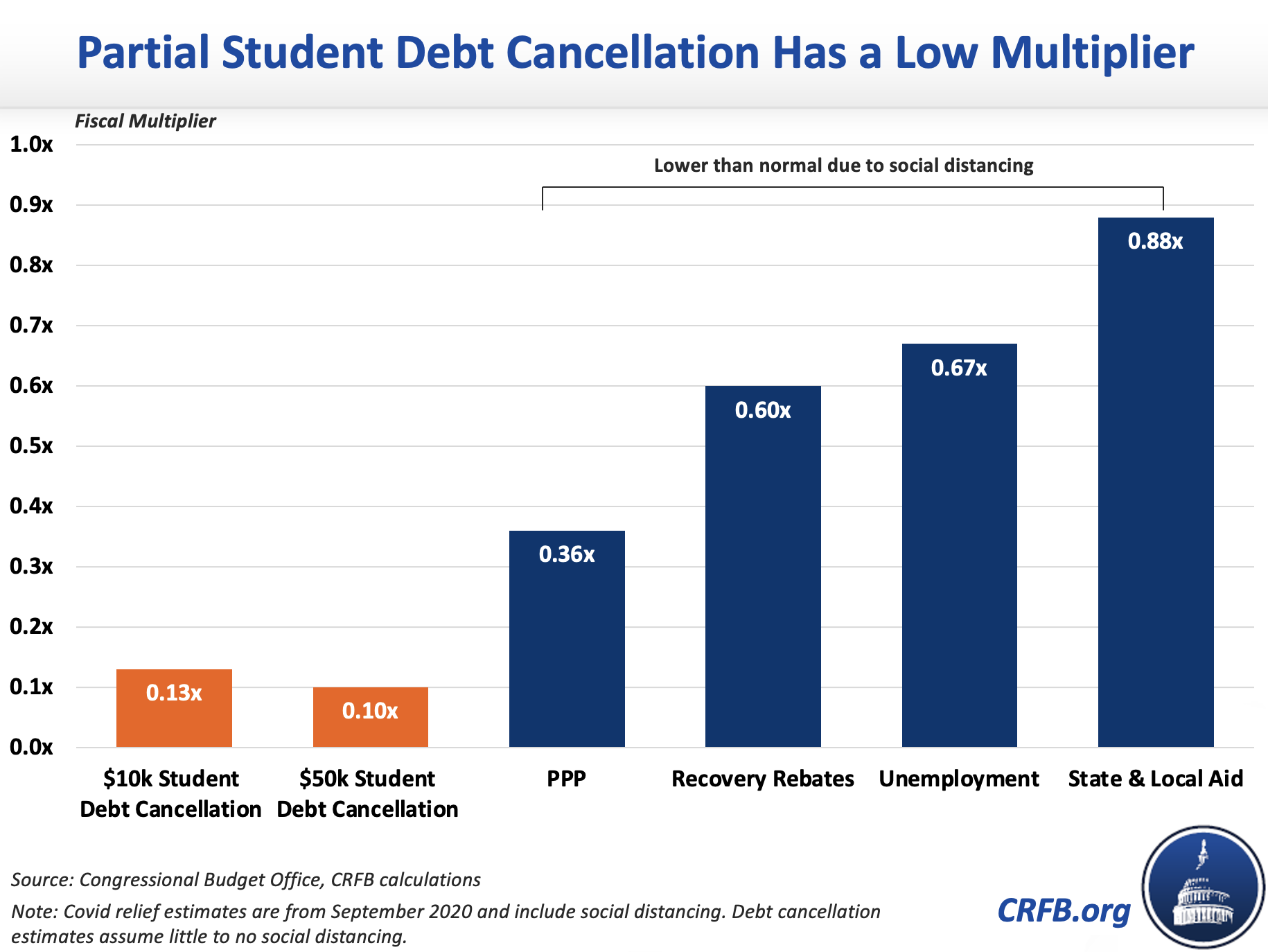

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

What Are The Pros And Cons Of Student Loan Forgiveness

Student Loan Forgiveness Statistics 2022 Pslf Data

Covid 19 Relief Bill Passes With Tax Free Status For Student Loan Forgiveness

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What Are The Pros And Cons Of Student Loan Forgiveness

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

Taxes On Forgiven Student Loans What To Know Student Loan Hero

What Are The Pros And Cons Of Student Loan Forgiveness

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget